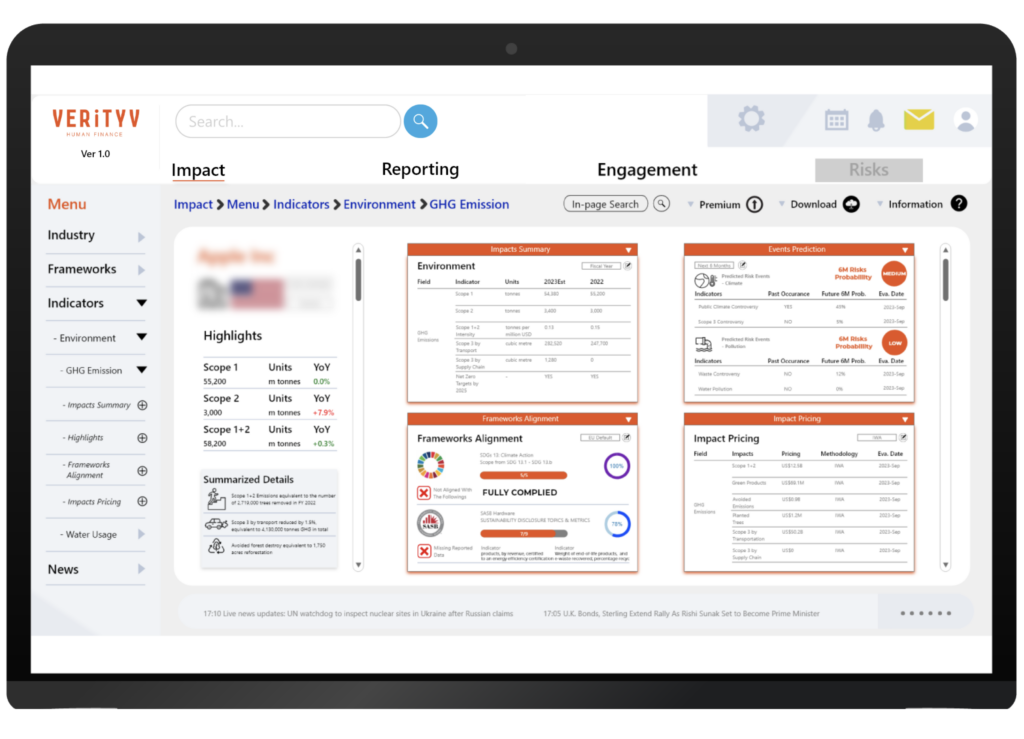

The Most Powerful Impact Data for Impact and Sustainable Investors on One Platform

How can we talk of impact if most impact data is not up to the task? Sustainability sounds hollow without real and granular impact data.

ESG data and ratings have failed to measure impact on the real world in quantifiable terms as reliable to investors as financial data.

When we couldn’t find impact data up to our standards, we decided to create it ourselves.

Impact

We combine the collection of structured and unstructured impact information with human supervised machine learning to create the most powerful and highest quality impact data available to investors today. Investors can treat our data with the same confidence and trust as they do with financial data.

Engagement

Fund managers have traditionally engaged with investee companies on financial and business issues. Under the Sustainability paradigm and with increasing regulation, our state-of-the-art impact data will empower investors to engage with investees on sustainability and impact matters with the same authority as they do on financial ones to ensure the positive contribution of their investments on climate, social and biodiversity issues.

Reporting & Compliance

Investment today means investing globally with supply chains spanning all time zone, as well as adherence to different reporting frameworks. Our data allows investors to align the impact of their investments with all the following framework: EU SFDR, UN SDGs, EU Taxonomy, SASB, TNFD and FCA SDR.

Impact Risk Cost

Once you can really measure impact, the power of the data really manifests itself in the ability to calculate the cost of the impact for the climate, society and biodiversity.

To be truly sustainable, an investment must include the cost of the external impact of its products and services, and its effect on the bottom line of the business. Our impact pricing and risk modules give your sustainability hitherto unimagined dimensions of real world materiality.

Social-Based Human Supervised AI

Our human supervised machine learning is based on rigorous social-based methodology to ensure relevance and quality control in our data sets.

Our platform produces unique and verifiable data covering 18 sustainability themes and almost 300 KPIs covering the confluence of climate, social and biodiversity.

Class Coverage Mean All Assets Have Measurable Impact

Our platform initially covers listed equities of all major global markets and has already begun adding functionality for regional hub markets. We also would cover corporate and government fixed income. We are also working to introduce functionalities for clients to upload Private Equity, Distressed Loans, Nature Based Solutions and other private non-listed assets to accurately measure their impact

User Friendly APIs for Single Investment and Portfolio Management

Our system is made to integrate with existing investment software so investors can upload portfolios of listed assets,

Standardization of Data for Greater Impact Choice

With our unique impact data standardization tools, it is possible for investors to compare impact of not only assets within the same class, but across classes

The Verityv platform makes impact investing precise and material